How to Improve EBITDA Margin? [Tips and Strategies]

What might be considered a good EBITDA margin is relative and depends on the industry and the specific company's approach. For example, a smaller company with a higher margin could be said to be.

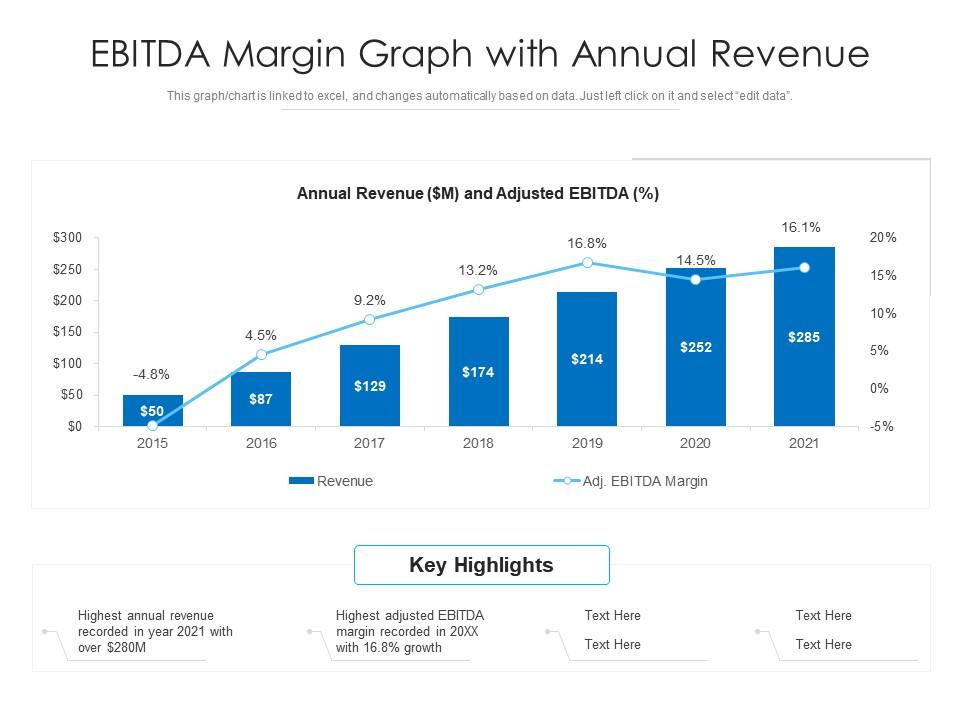

EBITDA Margin Graph With Annual Revenue Presentation Graphics Presentation PowerPoint

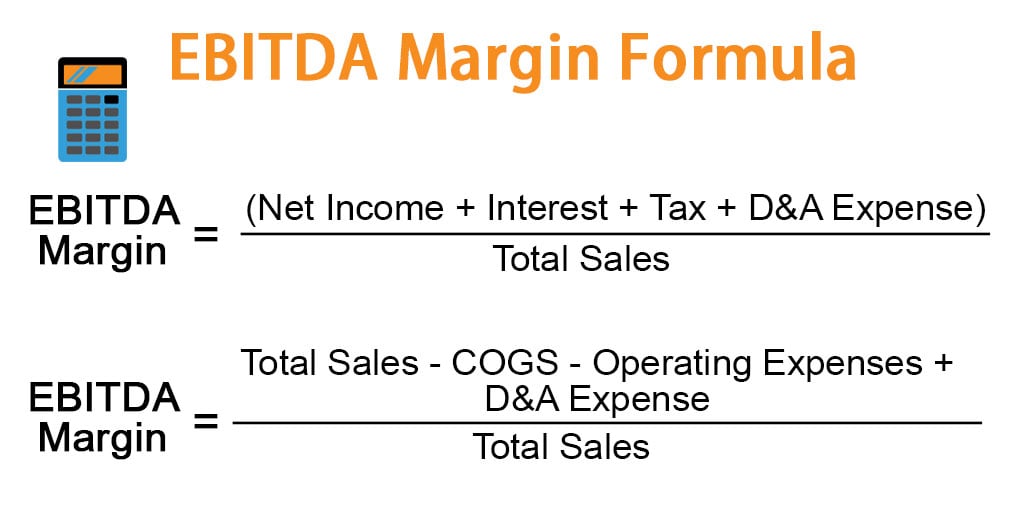

EBITDA margin is a profitability ratio that measures how much in earnings a company is generating before interest, taxes, depreciation, and amortization, as a percentage of revenue. EBITDA Margin = EBITDA / Revenue. The earnings are calculated by taking sales revenue and deducting operating expenses, such as the cost of goods sold (COGS.

Best Average profit margin home health agency 2017 with New Ideas Interior and Decor Ideas

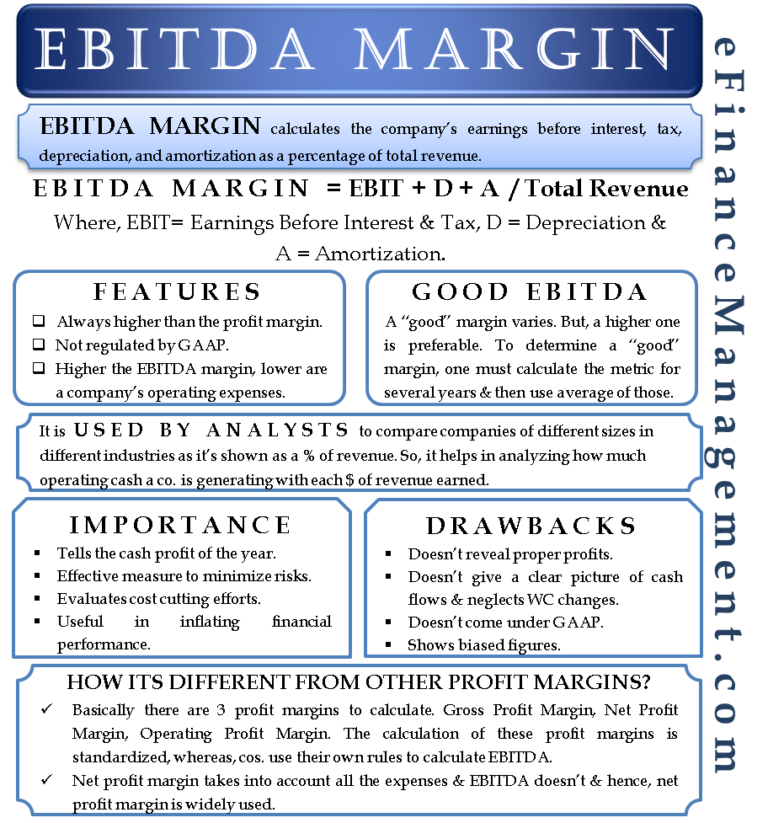

EBITDA margin is a measurement of a company's operating profitability as a percentage of its total revenue. It is equal to earnings before interest, tax, depreciation and amortization (EBITDA.

What is a Good Gross Profit Margin? CFO Hub

Your EBITDA margin should be in line with the SaaS industry average; the industry average is a good baseline goal but set your aspirational target higher. An EBITDA margin falling below the industry average suggests your business has cash flow and profitability challenges.

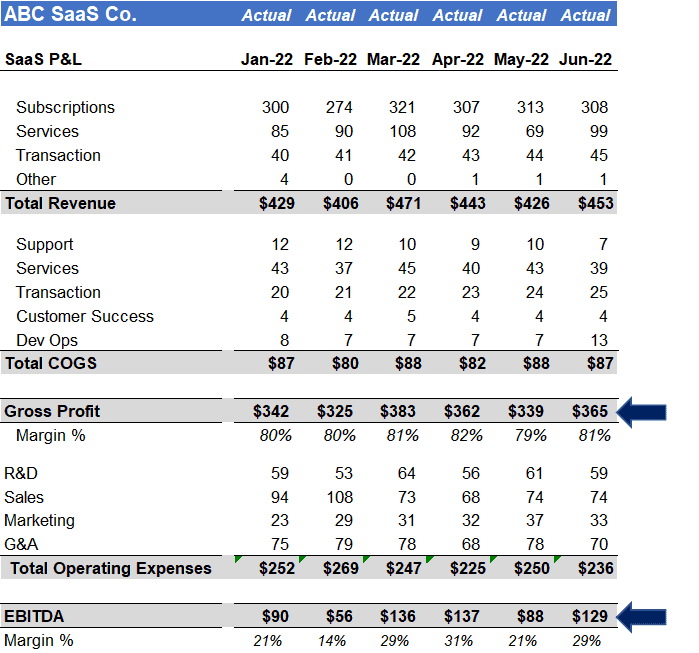

EBITDA Graph With Gross Profit And Margin Presentation Graphics Presentation PowerPoint

EBITDA margin is a measurement of operating profit as a percentage of revenue. It is calculated by dividing EBITDA by revenue and expressed as a percentage. The EBITDA margin formula is commonly used to compare the business performance of firms within the same industry. Lenders might also use EBITDA margin to assess the financial health of a.

What is Cashadjusted EBITDA The SaaS CFO

The EBITDA margin measures a company's earnings before interest, tax, depreciation, and amortization as a percentage of the company's total revenue. EBITDA margin = (earnings before interest and.

EBITDA Margin What It Is, Formula, and How to Use It

:max_bytes(150000):strip_icc()/ebitda_definition_final_0831-c8a1b26d38db49829a69a86f3c294779.jpg)

EBITDA margin by industry. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a commonly used financial metric that helps in analyzing the operational performance of a company. This metric excludes the impact of financial and accounting decisions, making it easier to assess a company's operational efficiency and.

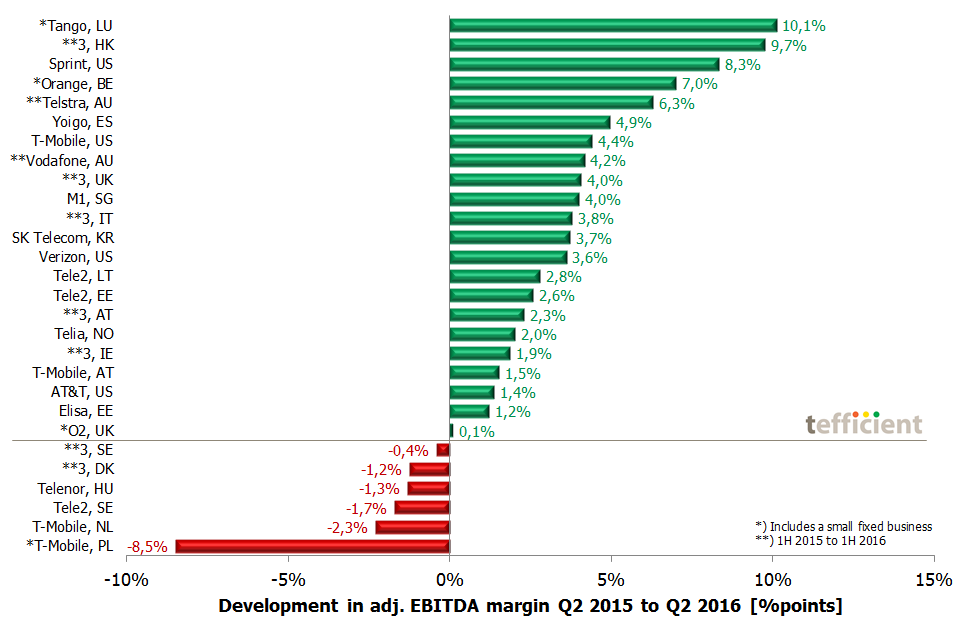

Without an attractive iPhone, operators’ EBITDA margin surges tefficient

The EBITDA margin is the ratio between a company's EBITDA and net revenue, expressed as a percentage. The EBITDA margin is a non-GAAP measure of operating performance intended to measure a company's core profitability on a normalized basis. The formula to calculate the EBITDA margin divides EBITDA by net revenue in the corresponding period.

LatentView Analytics Q2FY23 revenue grew 10 QoQ & 40 YoY; EBITDA Margin at 28

Average Operating (EBIT) Margin by Industry - 22 Years of Data [S&P 500] Historical Datasets, Ratios for Stocks. Updated 4/21/2023. Operating margin is probably the most useful profitability ratio because it's much less volatile than net margin but includes all operating expenses to run a business (which gross margin doesn't).

EBITDA Meaning, Formula, Uses, and Limitations Stock Analysis

EBITDA Margin is a financial ratio that measures a company's profitability before deduction of expenses like interest, taxes, depreciation, and amortization. It's calculated by dividing EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) by total revenue.

Gross Revenue Minus Cost Of Goods Sold

The EBITDA margin helps in comparing the relative profitability of two or more businesses of various sizes operating in the same sector. The formula to calculate is: EBITDA margin= EBITDA / total revenue x 100. When computing the EBITDA, excluding costs related to depreciation and amortization from the revenue is essential.

EBITDA Margin Formula Example and Calculator with Excel Template

Simply put, EBITDA margin is a company's operating profit as a percentage of its total revenue that allows investors to compare a company's financial performance to others in the industry according to Investopedia . Calculating EBITDA is an excellent shorthand way to determine how much cash a company has generated from its business operations.

EBITDA Margin Features, Importance, Drawbacks, Other Profit Margins

What is a good EBITDA margin? A good EBITDA margin is relative because it depends on the company's industry, but generally an EBITDA margin of 10% or more is considered good. Naturally, a higher margin implies lower operating expenses relative to total revenue, while a low or below-average margin indicates problems with cash flow and profitability.

Operating Margin Formula and Calculator [Excel Template]

EBITDA is an acronym that stands for earnings before interest, tax, depreciation, and amortization. EBITDA multiples are one of the most commonly used business valuation indicators that is often used by investors or potential buyers to assess a company's financial performance. The EBITDA multiple will depend on the size of the subject company.

EBITDA Margin Definition, Formula And Examples

When analyzing a company, creating a spreadsheet and putting at least five years of metrics like EBITDA on the sheet is a great practice to spot trends or isolate atypical years. Let's look at the EBITDA margin of some of the more popular companies. Meta (Meta) - 40.02%. Amazon (AMZN) - 10.8%. Apple (AAPL) - 33.4%.

What Is EBIT Margin? Valuation Master Class

A good EBITDA margin can vary depending on the industry the organization is in, and the scale of its business. However, in general, a higher EBITDA margin exhibits an organization's potential to generate revenue before accounting for interest, taxes, depreciation, and amortization, which is a positive indicator.

.