Home Equity Loan vs. Home Equity Line Of Credit Your Equity

A home equity line of credit (HELOC) is another way to secure the down payment needed for a second home purchase. Most lenders allow you to borrow up to 80 percent of your home's equity minus what you owe on your mortgage. So, if your home is worth $395,000 and you owe $285,000, you could get a HELOC for up to $31,000 ($395,000 * .80.

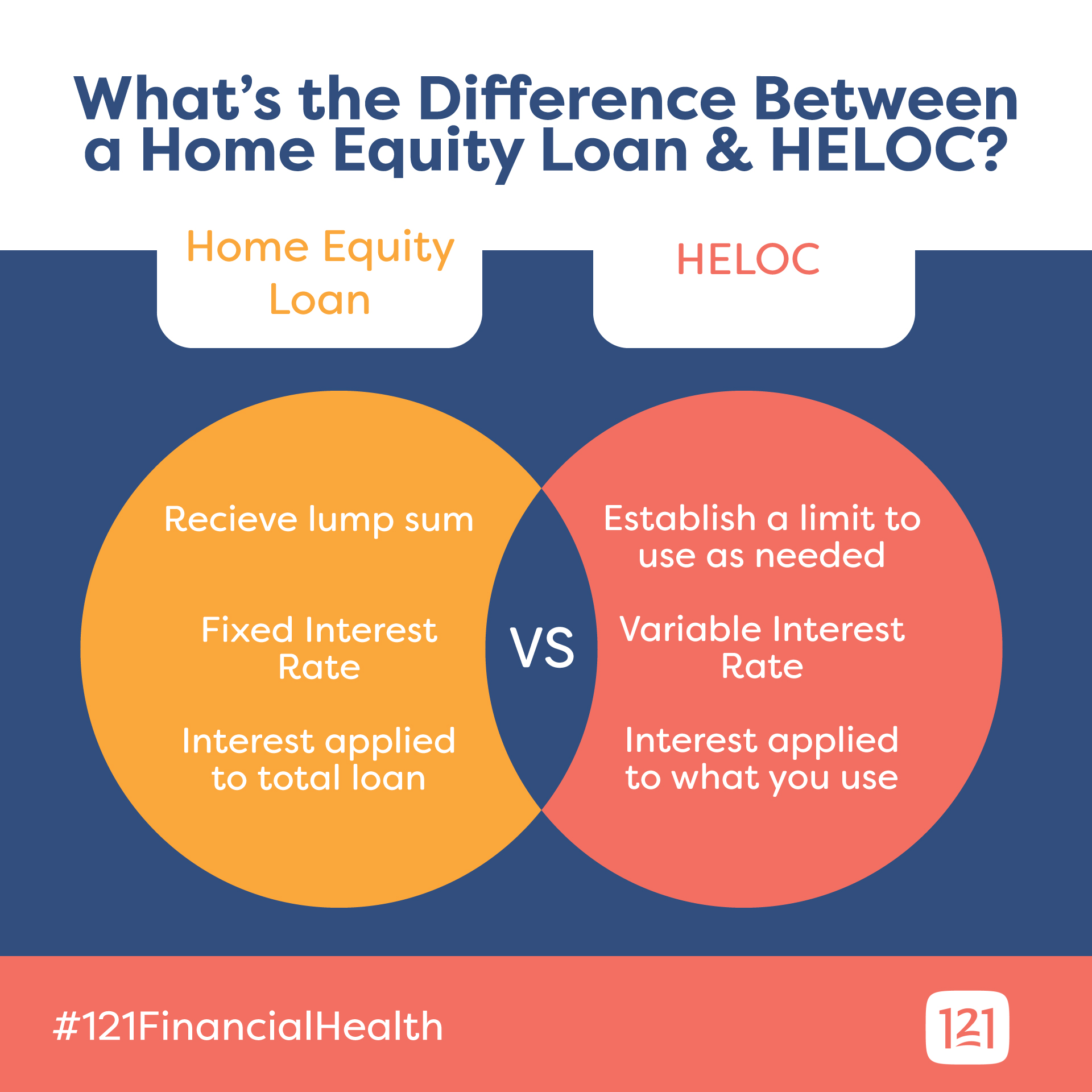

Home Equity Loan vs. HELOC What’s the Difference?

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Bridge Loan Definition. A bridge loan is a financing option that serves as a source of funding until you get permanent financing or pay off debt. Also known as swing loans, bridge loans are typically short-term loans, lasting an average of 6 months to 1 year. They can be used to finance the purchase of a new home before selling your existing house.

Best Bank For Home Equity Line Of Credit Home Rulend

Bridge loans and home equity lines of credit (HELOCs) are two methods of short-term financing used in the real estate industry. They are usually used in the consumer mortgage market to facilitate.

Home Equity Loan vs. Line of Credit Cobalt Credit Union

Often, home equity loans have lower interest rates and fewer fees than bridge loans do. It is a challenge to qualify for a home equity loan if your credit history is poor, but when you use your home as collateral, lenders feel more comfortable issuing a loan as it is secured. While bridge loans are typically due once your original home sells, a.

Home Equity Loan, HELOC or CashOut Refinance. What's Best? Citizens

The balance on the loan, along with all the accumulated interest due to the lender, are paid at the time the home is sold. In the final analysis it appears that the HELOC is the least costly form of short term financing, assuming that you are able to carry all three payments and while the bridge loan is more costly, the re-payment is more.

Home Equity Loan vs. Line of Credit Clearview FCU

This is unlike you would on a home equity line of credit. The balance on the bridge loan, as well as the interest, is paid at the time the old house is sold. Advantages of a Home Equity Line of Credit (HELOC) The home equity line of credit is a type of loan where the collateral is the equity in your home. What makes the HELOC different from a.

Home Equity Loan Or Line Of Credit Calculator Home Sweet Home

A lender that allows a combined loan-to-value ratio of 80% would grant you a 30% home equity loan or line of credit, for $90,000. » MORE: Compare the best HELOC lenders About home equity loans

Home Equity Loan vs. Home Equity Line of Credit YouTube

Bridge loans and home equity lines of credit, or HELOCs, offer homeowners the option to borrow by using their homes as collateral. Both loans provide funds to the borrower based on the amount of home equity available in their house; however, the use of those funds, among other factors, is what differentiates these two loans.

Home Equity Line Of Credit vs. Home Equity Loan…

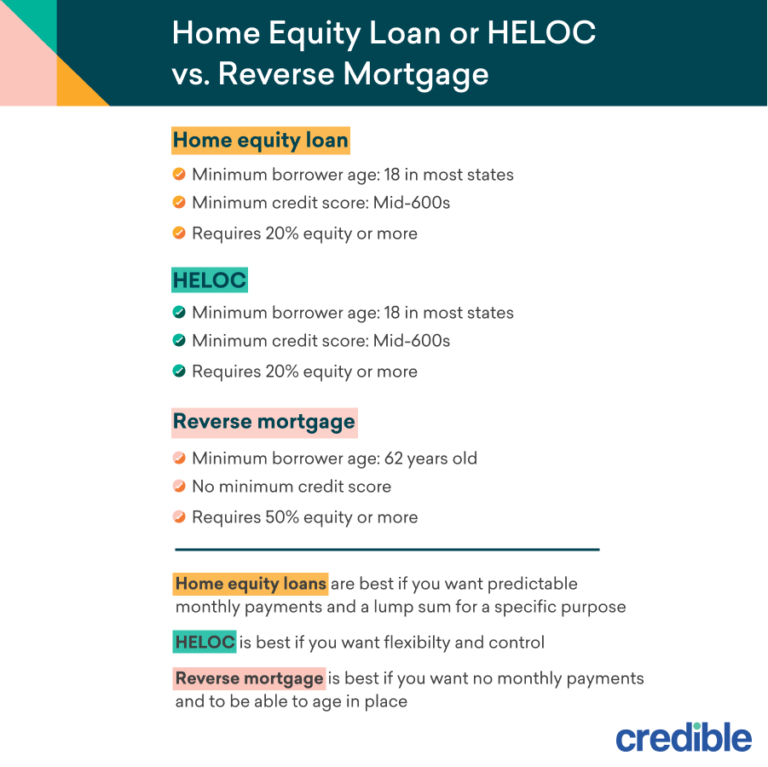

HELOC requirements will vary from lender to lender, but you typically need: Good credit: A credit score above the mid-600s will likely get you approved for a line of credit. A credit score above 700 is considered ideal. Qualifying amount of equity in your home: You should have at least 15% - 20% equity in your home.

Equity Line Of Credit

A bridge loan and a home equity line of credit (HELOC) are two options for short-term financing when you need temporary funding. For example, a HELOC or a bridge loan can help you cover your down payment if you sell one home and buy another. Using a bridge loan vs. HELOC for a down payment can depend on your financial situation.

HELOC or Home Equity Loan Which is Right for You? FREEandCLEAR Home equity loan, Second

The HELOC may be the better financial choice because the interest rate on a bridge loan mortgage will be greater than it would be on a regular mortgage. While a bridge loan can also be a valuable tool for short-term financing, it can be more expensive overall, and there may be additional costs that range from 2-4 %.

Home Equity Loan vs. HELOC What's the Difference?

:max_bytes(150000):strip_icc()/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)

A bridge loan, also known as a swing loan or gap loan, acts as a "bridge" between selling your current home and buying a new one. A bridge loan is a short-term mortgage secured by a portion of the equity in your current home, even if it's for sale, to use toward the down payment on a new home. Your home equity is the difference between.

6 Differences Between A HELOC and A Home Equity Loan Bob Vila

Bridge loans and home equity lines of credit (HELOCs) are two methods of short-term financing used in the real estate industry. They are usually used in the consumer mortgage market to facilitate buying property, but they are also used in the commercial real estate market. Bridge loans and HELOCs are quite different financial instruments, but.

Documents You'll Need for a Home Equity Line of Credit Bank of Hawaii

A bridge loan for 80% of the home's value, or $240,000, pays off your current loan with $40,000 to spare. If the bridge loan closing costs and fees are $5,000, you're left with $35,000 to put.

How Do Home Equity Loans Work?And When to Use Them

These loans are longer-term, usually allowing repayment of up to 20 years, and typically have more favorable interest rates compared to a bridge loan. HELOC: A home equity line of credit (HELOC.

Home Equity Loan or HELOC vs. Reverse Mortgage How to Choose Credible

Home equity lines of credit (HELOCs) and home equity loans are two similar finance tools — methods of borrowing money against the ownership stake you have in your home. Both typically allow you.

.